iowa city homestead tax credit

For homeowners with a principal residence in Maryland the Homestead Tax Credit limits increases in assessed property value. Military Tax Credit Exemption.

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Amazing Maps

Qualifying homeowners can get up to a 7000 reduction based on the assessed value of their home and primary residence.

. If the property is within the 100 year flood zone a permit must be obtained with DNR approval before beginning construction. Planning new construction or a remodel project. July 1 - The filing deadline for Homestead Credit Business Property Tax Credit Disabled Veterans Credit and Military Exemption.

Click to visit the GIS website. Each year the County Auditor determines for that district a levy that will yield enough money to pay for schools police and fire protection road maintenance and other services budgeted for in that area. The 2021 assessed value will be the basis of your tax bill in 2022- 2023.

All three departments are open through the noon hour. A city with a population of 10000 or more may elect to have their own assessor. Some common tax credits apply to many taxpayers while others only apply to extremely specific situations.

Property Tax Motor Vehicle and Drivers License. Phone 319 642- 3851. Tax Levies and Assessed Values There are a number of different taxing districts in a jurisdiction each with a different levy.

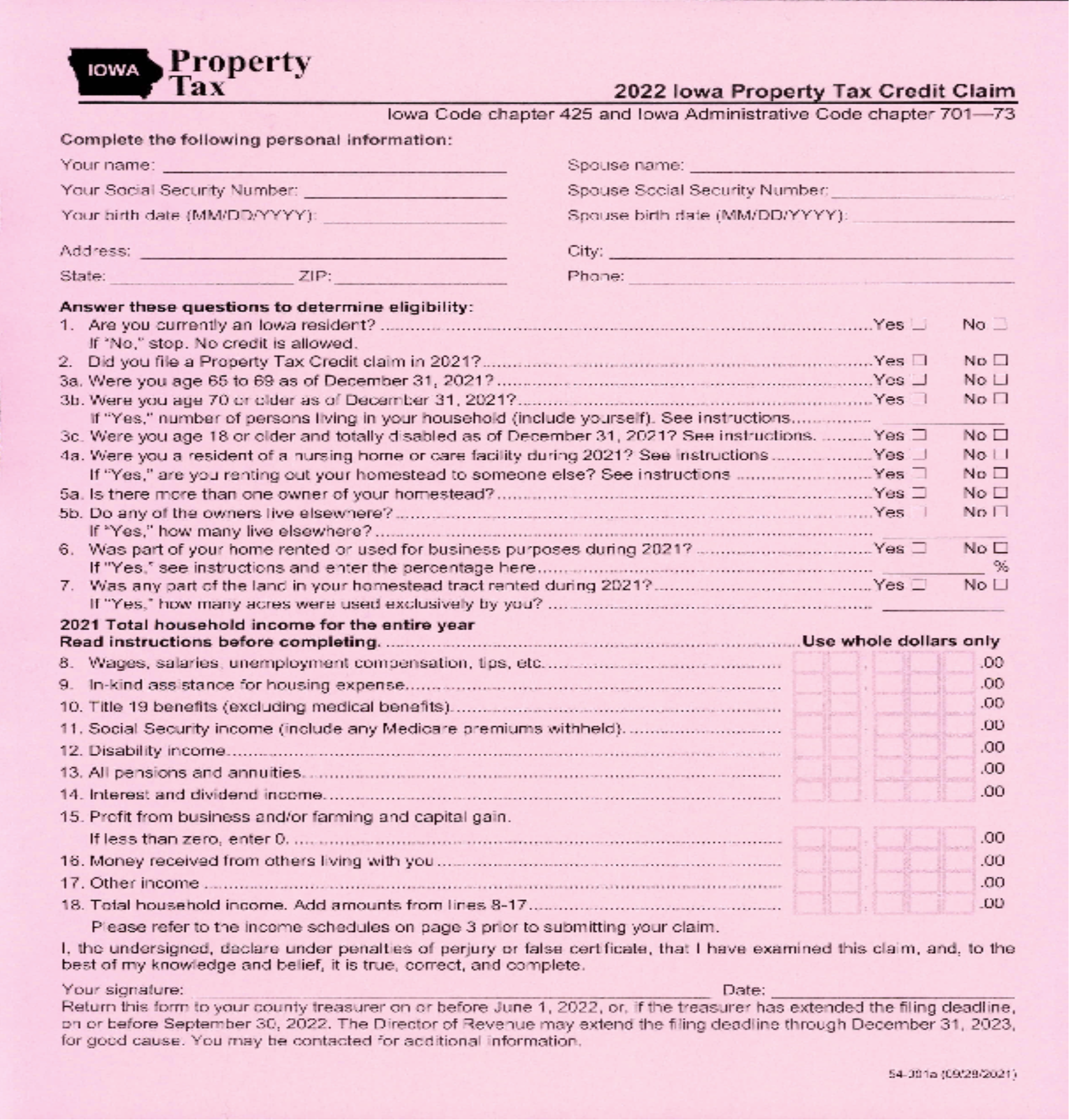

The credit caps property taxes based on income level. Tax credits and Exemptions. Homestead Tax Credit.

Credit and exemption will appear on the tax statement received the following year. Pocahontas County Iowa is a friendly safe and naturally beautiful rural area with truly welcoming and engaged communities. Homestead Credit Military Exemption and Business Property Tax Credit filing deadline is July 1 2022.

The deadline to file for Homestead Tax Credit Disabled Veterans Homestead Tax Credit Military Exemption and Business Property Tax Credit is July 1 2021 for the 2021 assessment year. However if you will be conducting business with the Drivers License department during lunch time please call ahead to. Contact Information City Assessors Office City Services Center 500 15th Avenue SW Cedar Rapids Iowa 52404.

03222022 City of Garden Grove Special Election. Monday - Friday. Assessors are required by statute to.

500 15th Ave SW Cedar Rapids IA 52404 Voice. Failure to do this may result in fines and may cause the county to lose flood insurance eligibility. Always check county FEMA maps to confirm that your project is not in the flood plain.

Click to View Real Estate Information. Quick Links Report a Concern. Wayne County Assessor Wayne County Courthouse 100 N Lafayette St Suite 205 PO Box 435 Corydon IA 50060 Voice.

Cedar Rapids City Assessor Iowa Assessor Hub provided by Vanguard Appraisals Inc Top. Madison County Assessor 201 W Court PO Box 152 Winterset IA 50273 Voice. Phone 515 462-4303.

Iowa County Assessors Office. Additional credits for seniors 65 and older and the disabled. In cities having an assessor the conference board shall consist of the members of the city council school board and county board of supervisors.

Disabled Veteran Homestead Tax Credit. Jessica Aldridge Assessor Ryan Hobart Chief Deputy Bridgette Allen Assessment Technician. 319 286-5888 Fax.

Another important tax credit is the Homeowners Property Tax Credit. 800 am - 430 pm. What is a Homestead Iowa Code 5611 defines a Homestead as The homestead must embrace the house used as a home by the owner and if the owner has two or more houses thus used the owner may select which the owner will retain Iowa Code 5612 limits the homestead to 12 acre within a city plat or 40 acres otherwise.

800 am - 430 pm. Homestead Tax Credit Exemption. This office consists of three departments.

A city with a population of ten thousand or more may elect to have their own assessor. January to November 1 Signup period for Family Farm Tax. Signup deadline Homestead Tax Credit Military Exemption.

Iowa County Pre-Construction Application. If you are not satisfied that the foregoing assessment is correct you may contact the assessor on or after April 2 to and including April 25 of the year of the assessment to request an informal review of the assessment pursuant to section 44130. Learn More opens in a new tab Demo Videos opens in a new tab Register for Webinars opens in a new tab Like us on Facebook opens in a new tab.

Qualifying homeowners can get property tax credit up to 375 per year. Historical Past-Year Versions of Vermont Form HS-122 HI-144. Please check individual departments for contact information and office hours.

The state limits increases to 10 but some city and county governments elect to use a lower limit. In most cases you will have to provide evidence to show that you are eligible for the tax credit and calculate the amount of the credit to which you are entitled.

Dream Farmhouse House Exterior Dream House Exterior Farmhouse Exterior

Property Taxes Marion County Iowa

Living Outside The City Has Always Been An Attractive Option For Many But With Housing Prices In Seattle Going Suburbs Washington Things To Do Housing Market

Property Tax Relief Polk County Iowa

131 W 71st St New York Ny 8 Bed 8 Bath Townhouse 14 Photos Trulia Trulia Townhouse Garden Floor

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

In Iowa Corn Fields Chinese National S Seed Theft Exposes Vulnerability Iowa Climate Change Water Utilities

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Monetary Policy

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Iowa Is Top Of The List For Retirement States Video Iowa House Styles Picturesque

Further Proof It S Not 2008 All Over Again Keeping Current Matters Equity Home Equity Line Of Credit

Interesting Case Study Getting Started In Real Estate Investing Even If You Don T Have Any Money Or Experie Investing Rental Property Investment Real Estate

What Is A Homestead Exemption And How Does It Work Lendingtree

1880 Stick Victorian Oil City Pa Oil City Victorian Homes Historic Homes For Sale

Available Tax Credits Deductions To Generate Cash Flow

In This Video We Discuss Chapter 20 Bankruptcy And Answer The Following Questions What Is Chapter20 Bankruptcy What Are The Chapter 13 Chapter Explained